High Momentum Stock Definition: A high momentum stock exhibits strong directional movement and maintains enough trading activity to sustain its trajectory. This sustained movement is powered by trading intensity, which we measure by the number of trades executed per second.

Trading is hard. The Power of Momentum Trading

There are many reasons why trading is challenging. This challenge stems from both human nature and the fundamental characteristics of trading itself.Fact: On the very short term, most price movements are random.

Fact: The human brain is wired to detect patterns.

However, momentum strategies offer one way to navigate through market randomness: when a security experiences a strong move sustained by very high activity (momentum), it can create a directional bias in price movement.The U.S. stock market is particularly well-suited for momentum strategies. With thousands of securities trading simultaneously, extremely skewed environments frequently occur. These situations can result in stocks moving 10%, 20%, 50%, or even more in a single trading day. To capitalize on these high-momentum events, traders need reliable detection tools. This is where MomentumDetector comes in: a specialized stock scanner that continuously monitors every security in the U.S. stock market to identify these momentum events.

Dissatisfaction with existing scanners

Today’s stock scanners are often expensive and overcomplicated, failing to deliver real value to traders.The Alert Overload Problem

Our journey to build MomentumDetector began with a common frustration: the overwhelming flood of low-quality alerts from existing scanners. You’ve probably experienced this: A scanner alerts you to a stock making new highs with an impressive percentage move in the last minute. But when you check the stock, there’s no real activity—just a dormant security with minimal trading. Sound familiar?Our Solution: Quality Over Quantity

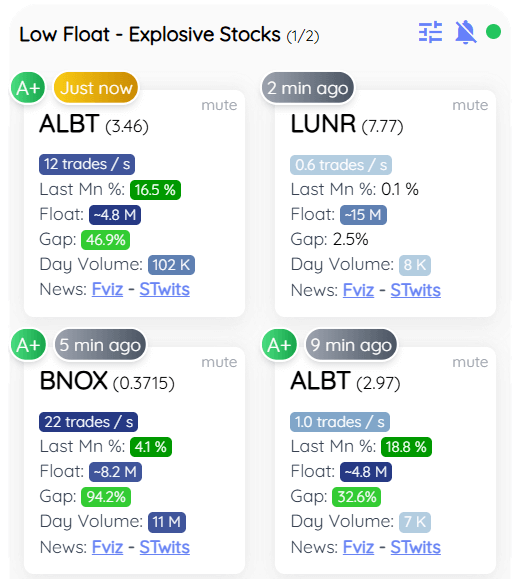

MomentumDetector takes a different approach. Before generating an alert, we verify genuine market activity by measuring trades per second (TPS). Unlike volume metrics, TPS counts individual trade executions regardless of size. Each executed order counts as one trade, providing a clearer picture of actual market participation. Higher TPS indicates more active traders and increases the likelihood of sustained price movement. This focus on TPS effectively eliminates those frustrating alerts from inactive stocks that waste your time and attention. While TPS isn’t a the holy grail, it’s a powerful initial filter. We recommend reviewing our educational blog content to learn how to maximize MomentumDetector’s potential through additional confirmation steps. However, the TPS metric alone significantly reduces false alerts from inactive stocks.Less is more: The Power of Selective Trading

The most successful day traders we know maintain laser focus: they specialize in one direction (either long or short), trade during specific market hours, and only execute high-quality setups. Think about your own trading: Haven’t your best days typically involved fewer, carefully selected trades? And haven’t your worst days often resulted from overtrading?MomentumDetector’s Philosophy: Elite Opportunities Only

We built MomentumDetector with a clear mission: to alert you only to exceptional trading opportunities—stocks with genuine potential for significant moves. This philosophy is embedded in our default “Low Float - High Of Day - High Potential” scanner. The process is straightforward:- Launch the scanner

- Wait for quality alerts

- If no alerts appear, it means there are no opportunities worth your capital—and that’s okay